U.S. Federal Reserve and Saudi Entrepreneur

How Changes in Federal Reserve Policy Directly Influence Funding Cycles and Startup Growth in The Kingdom

Date

Oct 30, 2025

Author

Upturn Editorial Team

Read

5 Min

What is the U.S. Federal Reserve?

The U.S. Federal Reserve is the central bank of the United States. Its primary mandate is to ensure the American economy operates at maximum efficiency through monetary policies, with interest rate decisions being among the most important tools.

Why does this matter for the Saudi entrepreneur?

Given the size of the U.S. economy, its influence on global markets, the scale of global trade, and most importantly the Saudi riyal being pegged to the U.S. dollar, Middle Eastern economies are significantly affected by changes in the American economy. This impact extends to the entrepreneurship and venture capital sectors in Saudi Arabia.

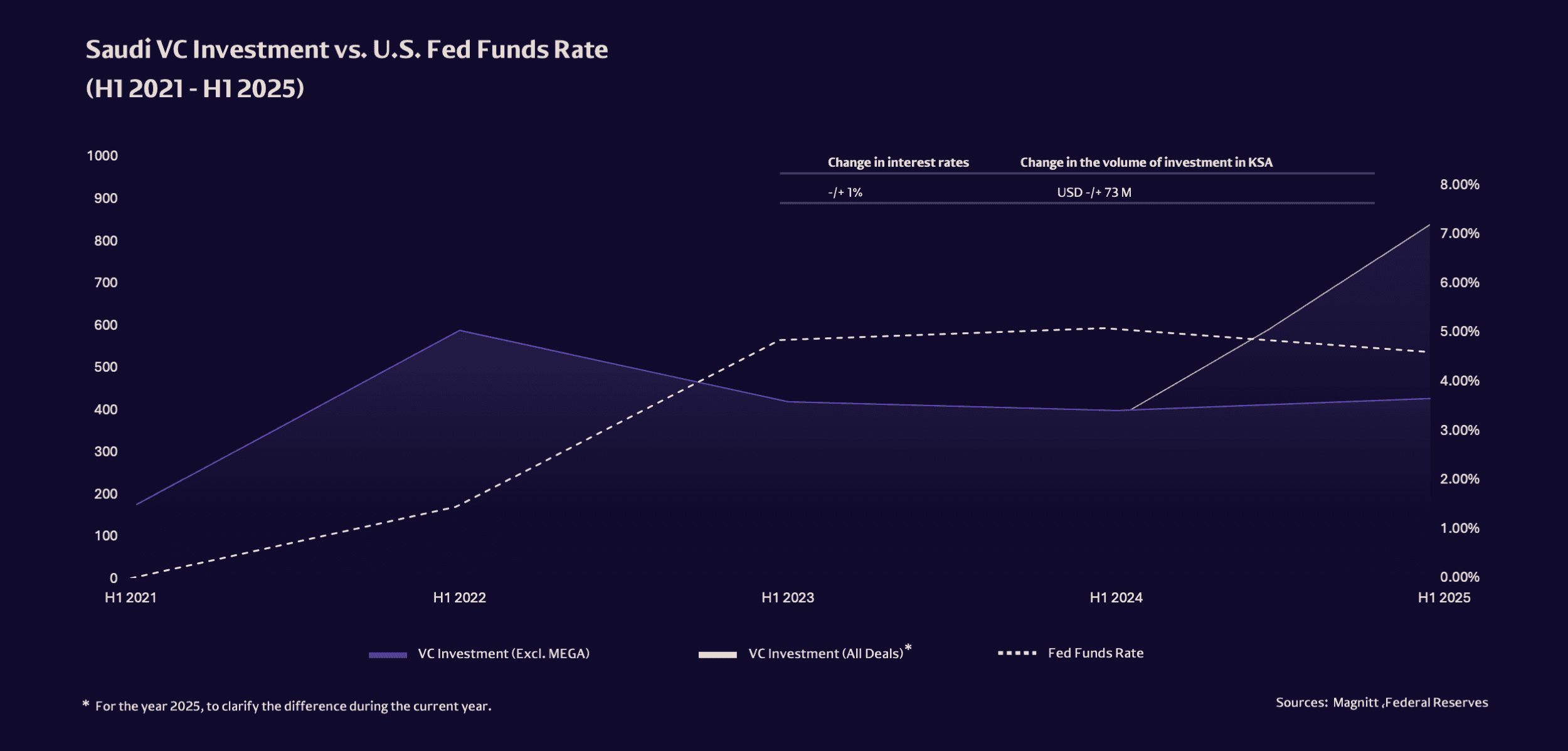

A Look at Saudi Venture Capital Trends Compared to U.S. Interest Rate Movements

Analysis of Changes in Venture Capital Investment Levels in Saudi Arabia in Relation to Interest Rate Shifts

2021 to 2022

Interest rates were close to zero and the venture sector experienced a major surge driven by expansionary monetary policies and the easing of pandemic related concerns. Venture investments in Saudi Arabia increased to more than triple during this period.

2022 to 2024

The U.S. Federal Reserve raised interest rates to around 5.20 percent by mid 2024. As a result, the volume of investment rounds in Saudi Arabia decreased by approximately 23 percent despite strong government support and an active entrepreneurship ecosystem.

2024 to 2025

The Federal Reserve reduced rates to the range of 4.25 to 4.5 percent. This shift supported a strong rebound in the sector, with venture investment levels rising by 116 percent between 2024 and 2025. The increase was driven mainly by large scale deals for mature startups preparing for public listing such as Ninja and Tabby.

This analysis focuses on the relationship between venture capital investment and interest rates and assumes the following conditions:

No major geopolitical disruptions

Continued government support for the sector

Stable demand for oil and gas with no significant decline in oil prices

Ongoing support from government backed institutions such as the Public Investment Fund and SVC

Conclusion

The purpose of this analysis is to draw the attention of entrepreneurs to the economic factors that influence the growth of their startups. One of the most significant factors is the effect that changes in U.S. monetary policy can have on a young company in Saudi Arabia. Entrepreneurs should remain informed about economic developments not only within Saudi Arabia but also in the global economy.